The Evolution of TV watching and advertising: Engaging viewers in a streaming-first world

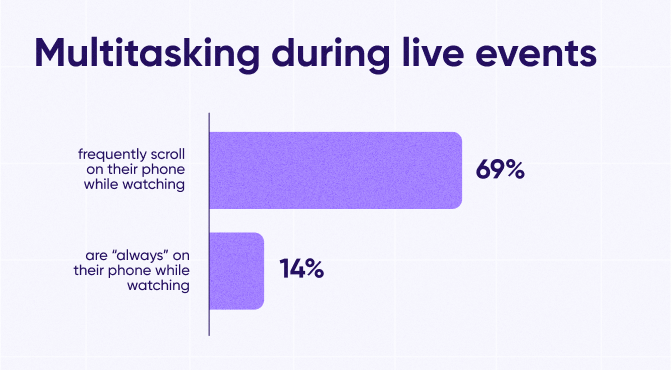

In the last few years, consumer technology and media habits have shaken up advertising strategies and product rollouts from publishers and CTV platforms. Beyond the major changes and advancements like the rollouts of ad-supported tiers, enhanced measurement and attribution, and rise of programmatic buying in CTV, there’s been a steady push for attention from advertisers – they want to know whether there are actually eyeballs on their ads. TV viewers are more distracted than ever, and with most streaming services now offering or requiring ads, it’s crucial to know if viewers are paying attention to them.

For a clearer picture, AppsFlyer sought to understand how consumers across generations and genders were consuming live and streaming television, how they engaged with advertisements during these content formats, and what types of purchasing actions they took due to those ads.

AppsFlyer and TEAM LEWIS surveyed 1,000 US adults in the early summer 2024, balancing the sample by age and gender. The survey aimed to understand how consumers engaged with live and streaming TV, how their mobile phone behaviors factored into their consumption, and ultimately what actions they took on their phones while, or after, watching TV advertisements. As advertisers navigate these shifts, the survey uncovers the key consumer preferences and behaviors shaping the future of advertising, across multiple channels.

Behavior during, and after, advertisements

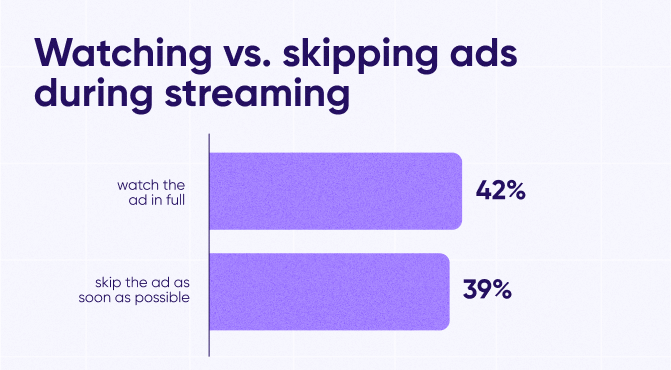

The good news is that more people are watching ads rather than skipping them. That’s why crafting ad content that connects with consumers isn’t just nice — it’s crucial. However, a majority do either skip or mute the ad.

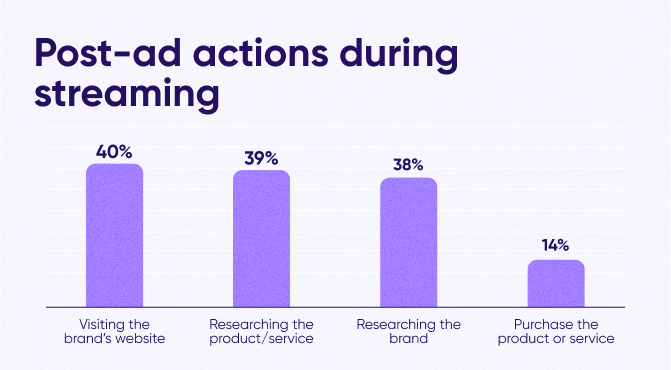

The study shows that consumers seeing your ad will often check out your website, dig into your brand (and/or products) through research, and in many instances download a company’s app. Throw in a good deal, and interest skyrockets.

Strong content opens the door; clever incentives and a fair value exchange invite them in. It’s about turning casual scrollers into curious researchers, and hopefully, customers.

So, we know people are watching the ads. Now, what are they doing after they see the ad?

Understanding whether or not consumers, and which ones, are viewing your advertisements is crucial. Knowing what they’re doing after they’ve actually watched the ad and if

Other purchasing behaviors and behaviors during live events

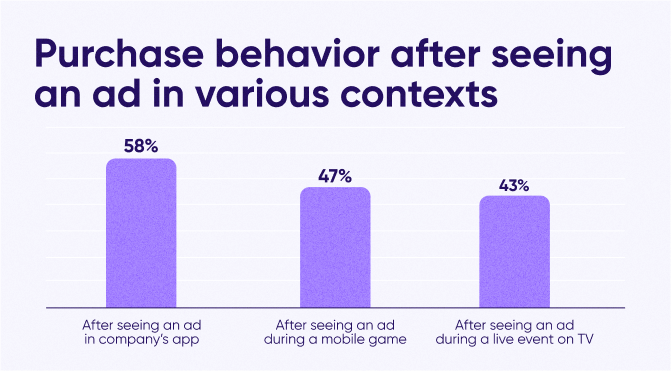

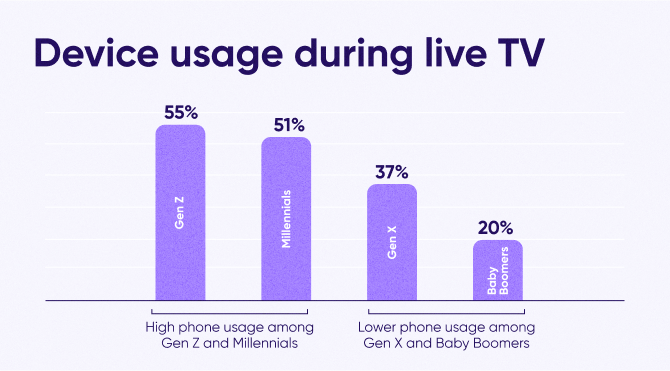

Audiences want more fluid and cohesive ad experiences across apps, games and live-streaming platforms. That’s why advertisers must step up their game in making their platforms more mobile-friendly and inject interactive or direct engagement strategies to catch the eye of younger shoppers like Gen Z and Millennials. These groups, notorious for multitasking with digital content, are also engaging in more ways with brands following advertisements than other generations – both on mobile devices and other devices.

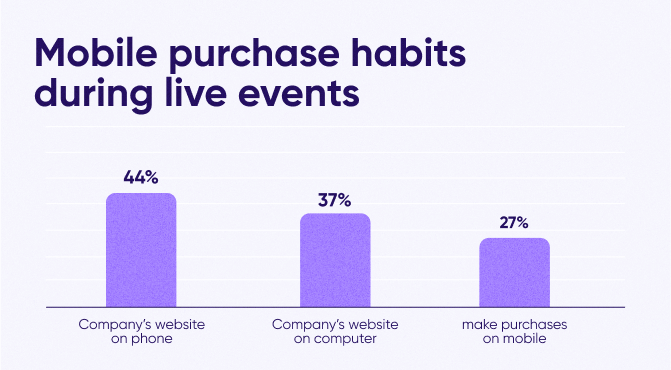

Yet consumers still prefer to make their purchases on the company’s websites, either on mobile or desktop. This suggests a significant opportunity for brands to enhance the mobile buying experience and make the most of real-time interactions during live events.

Demographics and differences in engagement with live TV and purchasing habits

There were a few surprises when it came to the demographics of the study – both from a gender and generational perspective. Gen Z is certainly the most mobile-first generation, but Millennials are not far behind. When it comes to these two generations’ engagement with digital ads, we’re seeing a big drive towards engaging with mobile and interactive marketing. They’re particularly active with ads they see in apps and during mobile gaming, they more often use QR codes to dig deeper into brands or downloading apps right off the bat. Ads that grab immediate attention and interaction play well.

With mobile devices remaining a media consumption staple, advertising strategies must pivot towards creating compelling, mobile-optimized content that resonates with the habits of younger audiences. This shift is essential for tapping into the dynamic and digitally fluent Gen Z market.

When it comes to Gen Z and their shopping habits, a whopping 78% of Gen Zers are hitting that “buy now” button after catching sight of an ad in non-gaming apps, compared to just 49% of the older crowd. And it doesn’t stop there; when it comes to in-game ads, Gen Z is again taking the lead, with 79% making purchases versus the 32% of Gen X and Baby Boomers.

In addition, nearly half of Gen Z (47%) are making purchases on their phones post-ad view, either within apps or on mobile browsers, in sharp contrast to the 28% of their older counterparts. And, if an ad prompts them to download an app, Gen Z is more than doubling the engagement compared to older folks, with 19% hitting that “install” button versus the 9% from Gen X and Baby Boomers.

Similarly, when it comes to engaging with brands, men and women show some interesting differences. Men are much more action-oriented when it comes to advertisements. They tend to make more purchases, do more research, and take actions like installing apps and engaging with brands on social media when compared with women.

Men seem to be all about those QR codes and making those impulse purchases at live events, showing a whopping 45% more likelihood to make on-the-spot buys compared to women. They’re also 17% more into checking out brand backgrounds than women. With social media, men are 44% more likely to hit that “Follow” button for their favorite brands and nearly two-thirds (63.6%) of men have been tempted to buy something after watching an ad during a live TV event.

When it comes to gaming, men again take the lead, being about 17% more likely than their female counterparts to make purchases after seeing game-related ads. Men are also 71% more likely than women to download a brand’s app.

In some ways, the findings reinforced priors for many. The younger generations, particularly Gen Z and likely Gen Alpha behind it, are spending a considerable amount of time on their phones – even when watching engaging events like live sports. This is important for advertisers and brands to keep in mind what their consumers are doing when you are trying to reach them.

Advertisers should continue to lean into an omnichannel marketing approach in order to have both brand awareness through TV/CTV advertisements but supplemented through performance-based mobile ads that can help drive conversions. At the end of the day, it is increasingly difficult to catch consumers’ attention, and with the data showing how often they are on their phones, finding ways to drive action will be more important than ever.