Alternative traffic sources for fintech mobile apps you need to know about in 2023

The fintech industry is on fire. According to Sensor Tower, in Q1 2022, the cumulative downloads of fintech and crypto apps reached a new high of 1.74 billion.

Pretty impressive, huh?

However, because the number of new fintech apps increases at lightning speed alongside the number of downloads, competition is also on the rise. Finding success with so many competitors out there is increasingly harder.

The largest mobile traffic sources may no longer be enough to generate the desired results. To help you scale within an increasingly competitive landscape, we’ve put together a list of alternative ad channels that could help you optimize your fintech app’s performance campaigns. If this is what you’ve been looking for, then read on!

The most popular doesn’t necessarily mean the most profitable

After the 2018 crypto boom, many traffic sources have become a lot friendlier to fintech ads. Multiple ad platforms have allowed or updated their guidelines to be more transparent and make ad campaign scaling more feasible within various markets.

The lion’s share of traffic for fintech is driven by Google, Meta, and Apple. These media sources are the most popular ad platforms for fintech apps thanks to their volume and share of potential paying users and the relative lack of fraud.

Applying the old saying “not to put all your eggs in one basket” is especially relevant in the world of fintech mobile apps. By diversifying your ad channels, you can expand your reach and target diverse audiences. After all, it’s difficult to know whether new rules and regulations will be implemented for forex brokers on platforms like Meta, Apple Search Ads (ASA), or Google Ads in the future?

If you rely solely on these large and competitive platforms, you may miss out on potential audiences and lose to competitors who have already explored alternative traffic sources.

Therefore, we’re going to dig deeper into what smaller traffic sources have to offer fintech apps — in quality and quantity alike.

The best alternatives for large traffic sources

We at AdQuantum have been working with many fintech apps for over four years and regularly examine the market for the best channels out there. Here’s where we recommend testing your next campaigns:

1) Twitter

This is definitely a digital platform worth testing these days. The platform is home to a large audience interested in financial topics such as trading, investing, cryptocurrency, etc. Could you imagine a better place for placing fintech mobile ads?

Statcounter gathered the stats on the popularity of social networks, broken down by country and region. Here you can assess Twitter’s popularity in different regions when considering this traffic source for your campaigns.

Based on our marketing data, the most popular GEOs for Twitter in regards to broker apps are Latin America, Nigeria, South Africa, Kenya, India, South East Asia, France, Germany, Italy, and Gulf countries.

Twitter has one of the most engaged audiences among all social networks, making it the ideal platform for thrilling fintech conversations and impressive engagement rates. Twitter users are also known to respond well to ads, resulting in improved conversions for targeted campaign events.

For marketing fintech apps via Twitter, it is important to consistently use a selection of keywords for different GEOs, regardless of whether it is a crypto, investment, banking, or forex app. User acquisition managers should also remember to correctly combine keywords and lookalike audiences based on subscriptions for Twitter accounts, people, and interests.

To effectively promote fintech apps on Twitter, it is crucial to understand the target audience, their needs, and interests. Furthermore, the text for ads on Twitter holds more weight than on other platforms, given that Twitter is a platform for text-based blogs.

Therefore, it is important to pay more attention to this aspect and create at least 10 different texts per single creative. Launching one creative and changing the text from 1st to 10th, measuring the results, and then choosing the best text to use for the remaining creatives is recommended for optimal results.

2) TikTok

The TikTok audience is maturing, their interests are expanding, and their solvency is increasing. And the platform itself has become more loyal to fintech ads in turn.

According to TikTok’s data, there was a 2.7x growth in video views of finance-related content on the platform from 2020 to the end of 2021. This indicates that both TikTok users and creators are increasingly interested in finance-related content. Moreover, a recent survey found that 54% of people are more likely to turn to TikTok for finance-related content than other platforms, and 1 in 2 have purchased a financial product they saw on TikTok.

If you haven’t tried TikTok as an ad platform for your finance app, now seems the best time to do so.

3) In-app ad networks

These are the platforms that connect app advertisers with app developers or publishers to display your ads in mobile games and non-gaming apps.

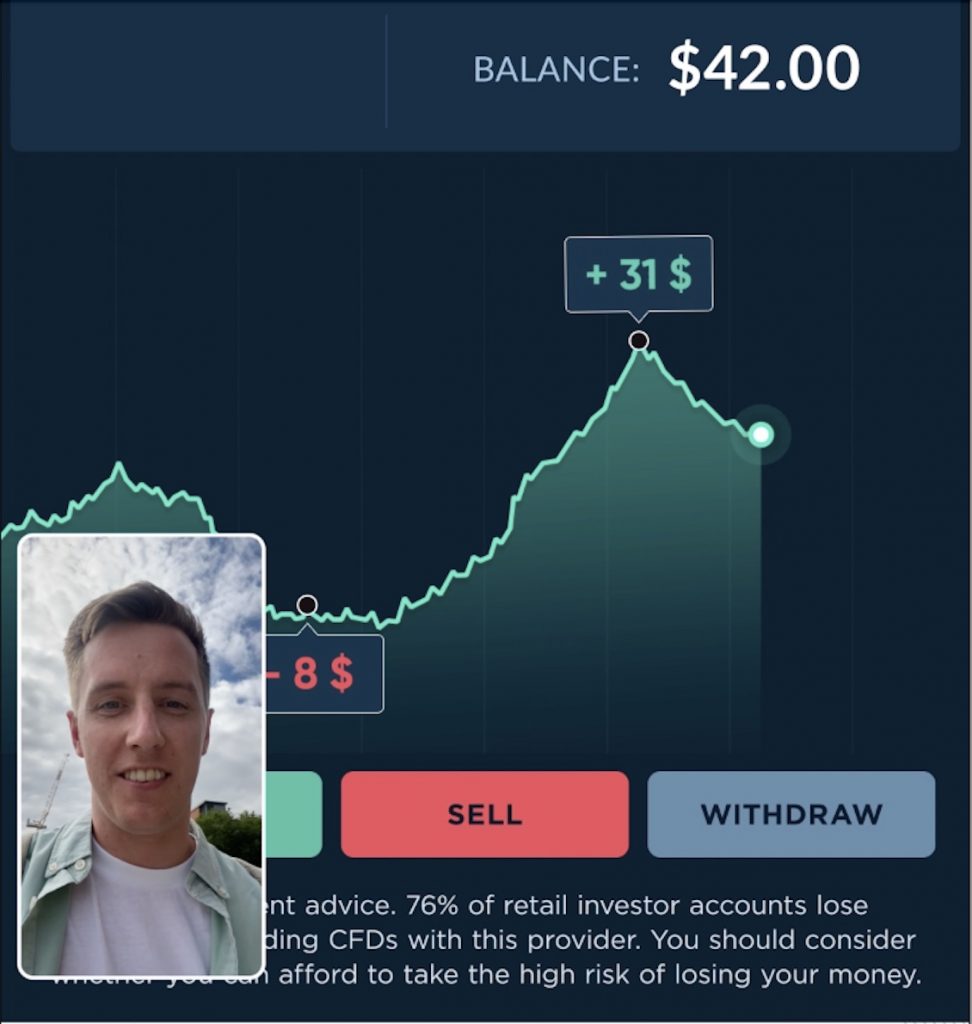

Among the advantages of in-app ad networks for fintech apps is an unexplored audience that is absent on social media, an easier pass as far as moderation and whitelisting goes, and a presence on both regulated and unregulated markets. Regulated markets require licenses for financial services and have strict rules, whereas unregulated markets offer greater freedom for businesses to operate, as there are no strict rules or oversight.

There are different types of mobile ad platforms offering various advertising options, however, we suggest that you focus on the networks that actively develop fintech-specific inventory and support CPA or ROAS optimizations. For example, Unity Ads, AppLovin, Vungle, and Mintegral.

The CPA and ROAS-based campaign optimizations are particularly beneficial when it comes to the fintech app vertical.

CPA is a type of advertising model where the advertiser pays only when a specific action is taken by the user, such as making a deposit in a Forex trading app. For Forex trading apps, optimizing for the CPA event of the first-time deposit is crucial because it helps to attract new traders and generate revenue.

On the other hand, Return on Ad Spend (ROAS) is a metric used to measure the effectiveness of an advertising campaign in generating revenue. ROAS optimization helps Forex trading app marketers to identify high-quality traders who are more likely to make bigger initial deposits. By targeting these high-value users, the app can generate more revenue while keeping advertising costs low.

Moreover, by using in-app ad platforms, fintech advertisers can access a more flexible automated inventory that is better suited to their user acquisition activities. They don’t need to worry about how the conversion rate will be affected by changes in CPI or whether it will change at all.

4) Demand-side platforms

Demand-side platforms (DSPs) allow you to bid automatically on mobile ad inventory from various publishers.

It’s crucial to choose a high-quality DSP that can optimize towards the KPI of your desired event and an algorithm training period that does not exceed one month. It is also essential to find out about the inventory: the DSP should be connected to major ad exchanges and offer traffic globally. These are for instance Moloco or Liftoff.

We recommend paying attention to campaign setting tools: targeting options, whitelist/blacklist of publishers, GEO selection, device type, etc. Fraudulent traffic remains a significant challenge for some advertisers, so make sure to use available market solutions to protect yourself.

5) Local publishers

For those who want to diversify traffic sources and launch ad campaigns across different GEOs, local publishers can be a great fit.

Direct media buying in Asian countries, for example, may be challenging due to some communication difficulties. However, local Asian publishers such as KakaoTalk and Line would be of great use here. They help you to open ad accounts where you place creatives, set up campaigns, and run them independently.

6) Influencer platforms

Blogger and micro-influencer platforms are another great alternative traffic source for fintech apps. JetFuel is a good example. It allows you to bring in a highly engaged and loyal audience to your product. Some of the best influencer platforms are Influencer Advertising Network by Liftoff, Linqua, LetsTok, imai, and BuzzGuru.

Key takeaways

- While advertising fintech apps on large platforms remains popular, it’s important to avoid relying solely on one or two channels. This can protect your business from unexpected changes in algorithms, ad policies, or audience behavior that could negatively impact your performance.

- Twitter is one of the most promising digital platforms for broker apps, as it is home to a large audience interested in financial topics. The platform is among the top three or five most popular social networks in various regions, and its users engage well with ads, improving conversions.

- When deciding what to test, consider your user profile, product, KPIs, and budget for testing. Take a deeper dive into the available tools, your target audience’s behavior, and the types of ad creatives you can use. This will minimize the risk of losing money.

- Whether you’re using social networks, in-app ads, or collaborating with influencers, remember that some advertising platforms may not be a good fit for your business or have high levels of fraudulent activity. Avoid wasting time and money on these platforms by taking a deeper dive into your product.

Ultimately, success in fintech advertising requires agility and adaptability. Keep testing, exploring new traffic sources, and adapting to changes in the digital landscape. With the right strategy, you can reach a wider audience, protect your app from unwanted fraudulent traffic, and achieve your marketing goals.