New data reveals: Owned media + deep linking reign supreme in 2025

Over the past two years, the number of re-engagements from owned media campaigns surged, outpacing the growth we’re seeing in paid remarketing campaigns. With growth coming from both directions, marketers are actually mastering the art of combining these activities.

Customer loyalty is a growing priority for brands, with owned media playing a key role in achieving this goal. In a reality of strict ROAS targets and privacy-driven signal loss, leveraging 1st party data signals and deep linking technology in owned media is key to optimizing user experience and ultimately improving lifetime value.

In this blog, we’ll dive into some key data trends from the world of owned media and deep linking, including conversion rate benchmarks and growth rates, while offering some practical and common use cases.

Owned media growth trends

First, the facts. Deep linking and owned media usage are expanding across all major channels: SMS-to-app, email-to-app, QR-to-app, and web-to-app. Our data reveals a 64% increase in owned media conversions in 2024 compared to 2023.

As you can see in the chart below, the owned media charge is driven largely by web-to-app campaigns where conversions surged a staggering 77% in 2024 compared to 2023, with Finance leading the charge with over 200% year-over-year leap.

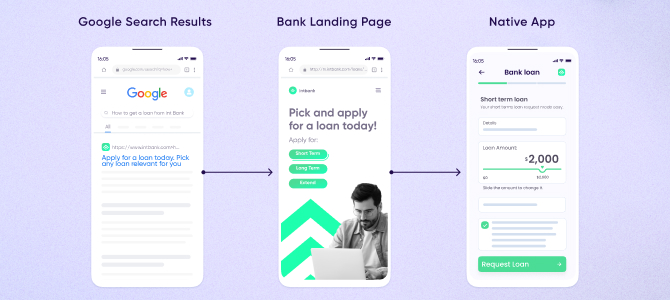

Web-to-app is driven by the rise of ‘contextual’ marketing, exemplified by the growing adoption of our Smart Script solution. When a deep link is used with Smart Script, the URL automatically generates a script that reproduces, in URLs and links, contextualized elements specific to the user’s journey. The result: a smoother transition from the web to the correct page within the app.

For example, Web-to-app transitions were a core focus for WorldRemit, an international money transfer service, ensuring users move seamlessly from the website to the app without friction.

By implementing deep linking and Smart Script, WorldRemit was able to pass contextual information from web to app, using QR codes, CTAs, and smart banners to create a more personalized journey. This shift led to significant improvements in LTV and CLV, with customers returning to complete more transactions.

Clearly, more and more brands understand that the app is superior when it comes to driving lifetime value, and direct users to install their app — whether they were immediately driven to install the app from a web acquisition landing page (as web is often cheaper than mobile app inventory) or are existing users of their web site.

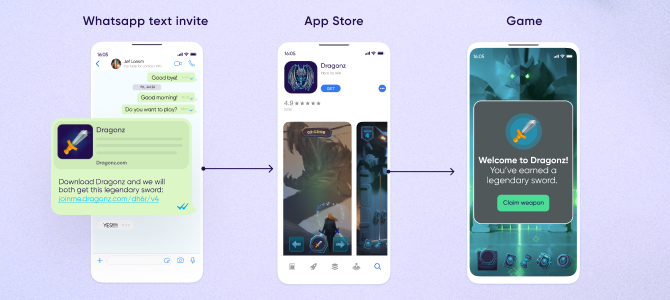

Shopping apps saw the biggest gain in email-to-app conversions, while gaming apps saw referral-to-app conversion more than double. The latter method is also a major contributor to lifetime value since players who were referred by a friend are far more likely to make a purchase.

Referrals encourage players to invite friends from within the game by offering an in-game incentive to both sides. Once friends get the invite via a messaging app and click on the link, they are automatically taken to the right app store to download the game. After launching the game, the new player will be redirected to the promised incentive.

The use of owned media and deep linking is not only on the rise across the globe (with the exception of Eastern Europe), it’s also the direction across industries — particularly in Entertainment, Books, and Finance — with multiple use cases in each industry.

Owned media performance benchmarks

The fact that owned media is experiencing such an impressive rise is no surprise when you examine the conversion rates. The ability to create great experiences with deep linking drives significant performance uplift in conversion rates — especially in the share of paying users, or re-engagement to purchase conversion rates.

According to our data, the conversion rate of owned media on average per category is almost double compared to paid media (which does not usually use deep linking); in every single category the gap is significant.

Just to name a few examples: Shopping apps in North America enjoy a 14.7% share of paying users in owned media compared to 8.6% in paid media. Finance in APAC see a 17.2% vs. 7.1% difference, while gaming apps in Europe are at 7.5% vs 2.2%.

A breakdown into owned media channels shows that email-to-app has the highest conversion rate at 17.7%, followed by QR-to-app and referral-to-app at 16.6% and 16.5%, respectively.

As we can see in the data, owned media powered by deep linking is extensively used and delivers strong results. But for what purpose exactly and for whom? Let’s explore this.

Survey: How marketers & product teams use deep links

A study conducted on behalf of AppsFlyer which will be published in March highlights the central role retention plays. Nearly 75% of marketers’ key objectives center on user retention and loyalty, including UX, re-engagement, and service quality.

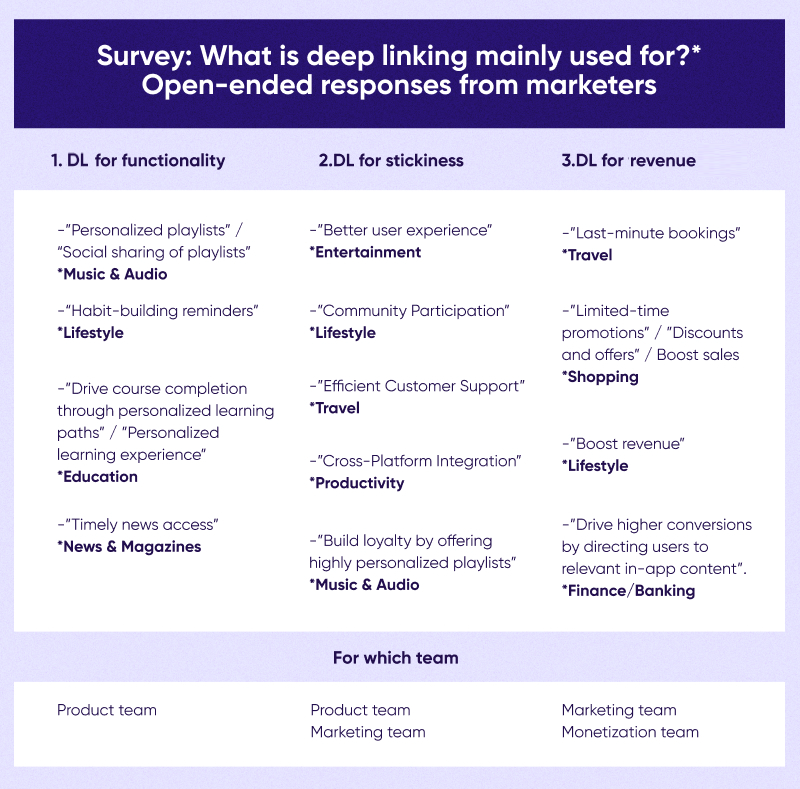

A significant number of marketers, CRM / lifecycle managers as well as product managers rely on deep linking to deliver personalized user journeys. A deeper look into the results shows that deep linking usage can be divided into three main goals, across several teams (an explanation follows):

1. Functionality for product. A technical function that seamlessly directs users from point A to point B.

2. Stickiness for marketing and product. The objective is to encourage and keep users active. Marketers typically refer to this as engagement and re-engagement. In this use case, product and marketing teams seek to ensure top notch UX to drive key retention and loyalty metrics, such as time in-app and engagement. From a marketing perspective, the goal here is to generate purchase intent.

3. Revenue generation for marketing and monetization teams. In this third goal, CX serves a short-term strategy. The facilitation of the user journey is primarily intended to encourage the user to take specific action to drive immediate profit and maximization of revenue. In this scenario, purchase intent already exists and the challenge is to remove any obstacles between that intent and the potential purchase.

While these three categories are relevant across all industries, each has its own characteristics. The type of service, and consequently, the LTV cycle, varies between a finance or news app, which rely on long-term usage, stickiness, and other categories like travel for instance, where brands often look to secure a one-time conversion. Clearly, in both cases, CX is vital.

Key takeaways

- Significant growth in owned media. Over the past two years, owned media conversions have surged by 64%, with web-to-app campaigns alone up by 77% in 2024, outpacing traditional paid remarketing efforts.

- Deep linking drives superior conversions. Leveraging deep linking technology creates personalized, contextualized user journeys that nearly double conversion rates compared to standard paid media approaches.

- Channel-specific strengths. Among owned media channels, email-to-app leads with a 17.7% conversion rate, while SMS, QR, and referral channels also deliver strong performance.

- Many benefits across industries. Deep linking is crucial not only for enhancing user retention and loyalty but also for generating quick revenue, making it a versatile tool across sectors like Entertainment, Finance, and Gaming.