Watch. Bet. Share: AppsFlyer Analysis Reveals When to Captivate TV Viewers on Their Second Screen during Eurovision Song Contest

May 13, 2024 – The Eurovision Song Contest 2024 captured the hearts and attention of millions across Europe, as it marked itself once again as one of the biggest TV events of the year. AppsFlyer analysis of mobile app usage throughout the event is shedding light on trends in app usage and which apps viewers turn to during an entertainment event like the Eurovision.

The Eurovision Song Contest’s appeal extends beyond borders, with staggering TV audience viewership market share reported across various nations. Greece led with an impressive 68.8% share, followed closely by the UK with 56.3%, and Germany with nearly 40%. However, TV audience viewership only tells one half of the story, as entertainment consumption is evolving and now exists on the first and the second screen for most viewers.Understanding the second screen and TV usage patterns is even more important when there are no commercial breaks or traditional advertising occurring during the show. Insights from AppsFlyer data underscored the significant impact of the event on the second screen by analyzing app engagement, and saw that primarily betting and social media apps came away as the app winners during the Eurovision. In regards to betting, AppsFlyer found interesting activity throughout the show, including:

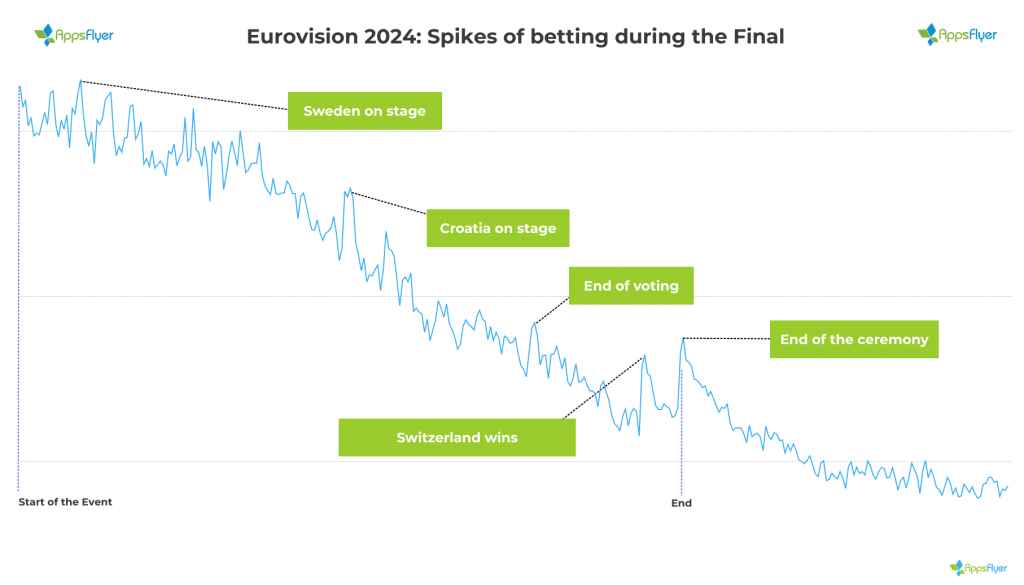

- At the start of the show: Spikes in betting activity were notable right at the start of the show (around 9 pm CET) and with the beginning of the live performances.

- Throughout the performances of the show: Activities in betting surged notably during anticipated acts like Croatia.

- Another spike in sessions can be observed towards the end of the show to place a last bet and during crucial moments of the event such as the end of the voting, after the disclosure of the winner and the end of the show at 1 am CET on May 12, when people opened their apps to check on their wins and losses.

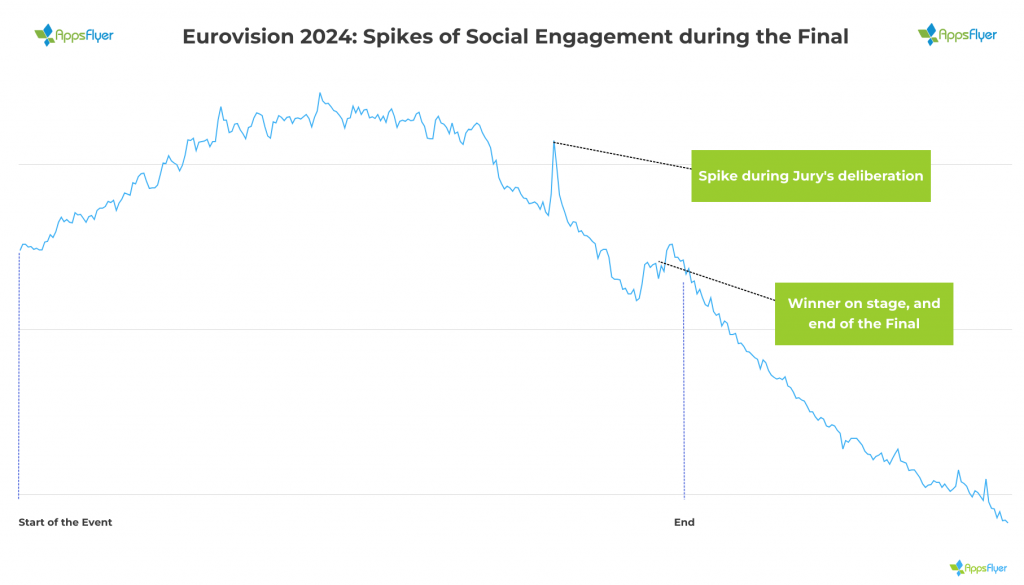

As expected, the TV event generated a lot of interaction on social media platforms and social media engagement was higher than average across Europe. During the broadcast, the most noticeable peaks coincided with pivotal moments such as Croatia’s act on stage (20% spike in social app engagement), and increased significantly when the jury’s votes were disclosed (42% spike in social app engagement). A last spike was observed during the final winner’s performance and the end of the show (38% spike).

Shani Rosenfelder, Director of Content Strategy & Market insights at AppsFlyer, reflected on the Eurovision Song Contest’s unique appeal from a marketing standpoint, stating, “The Eurovision Song Contest is a fascinating case study in marketing. The rapid succession of music acts, free from commercial breaks, keeps viewers on the edge of their seats. It’s a rare environment where the audience is captivated for hours, with the second screen utilized primarily for betting and communication purposes. This show is no place for traditional advertising – brands that want to engage with the Eurovision Song Contest audience, that heavily consists of the coveted 14-49 age group, have to get really smart in terms of timing when running their mobile campaigns.”

Paul Wright, AppsFlyer GM Western Europe and MENAT, noted that there are still untapped opportunities for marketers from the show, saying “It is noteworthy to mention that no significant spikes in app sessions were observed in the categories of food delivery and transportation during the Eurovision Song Contest broadcast. Food delivery and transportation apps should adapt their marketing strategy to the specifics of the TV event as viewers have hardly any time to place orders from the start of the spectacle. A targeted approach to reach the audience works best a few hours before the event.”

Methodology

Utilizing a geographically diverse dataset, AppsFlyer’s methodology entailed the analysis of 12 million sessions from 1,600 apps from key markets, including the United Kingdom (32%), Spain (22%), Germany (24%), and France (22%). In addition, AppsFlyer measured the verticals of Food Delivery, Music, Social Media, Betting (including Sports Betting) and Transportation.