what does ARPU stand for?

The acronym ARPU stands for Average Revenue Per User.

Try searching for

Average revenue per user (or unit), aka ARPU, is a measurement that helps all types of companies understand how much money, on average, they are generating from a single customer over a set period of time.

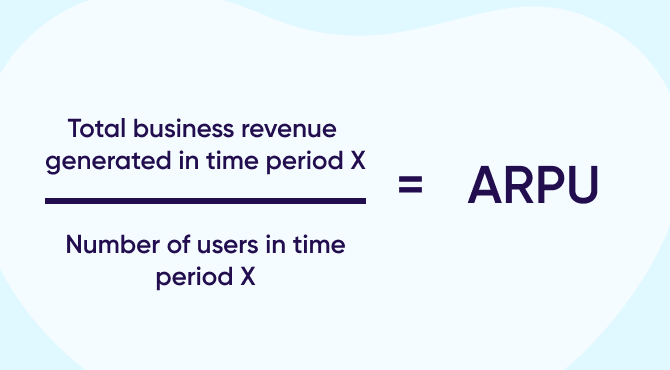

ARPU, as it’s generally known, is a ratio calculated by dividing the total revenue of a business for a given period by the number of users in that same period.

This shows you how much money the average user (or customer) is bringing in.

Note: In mobile app lingo, the “user” mentioned above is most often referred to as an “active user”.

ARPU is one of the most important metrics for any business as it tells you how much money you’re earning, on average, from each user in a given time frame.

Armed with that information, you can take steps to make your business even more successful — here’s how:

There’s a simple formula for calculating ARPU:

As ARPU shows revenue, it’s expressed in monetary terms.

The time period you focus on depends on your business, but for many mobile businesses and apps, it makes sense to calculate ARPU monthly. This is particularly true if you operate a monthly subscription model (like Netflix or Spotify), where you’re measuring monthly recurring revenue (MRR).

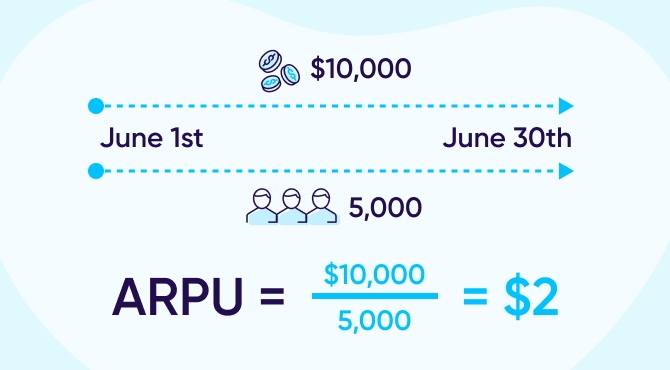

Let’s say your subscription business generated $10,000 between June 1st and June 30th, and you calculate that 5,000 users engaged with your brand at least once in the same time period: 10,000 revenue divided by 5,000 users gives us an ARPU of $2.

Businesses with more sporadic usage, like those in the travel or eCommerce industries, may opt for quarterly time periods, as their users tend to buy when they need or want a product rather than at set intervals.

For all businesses, remember that the total revenue includes new users, existing users, upsells, and cross-sells.

So far, we’ve looked at activity-based ARPU: revenue generated by all users in a specified period of time.

But for mobile marketers, it’s often helpful to break things down further. Enter: cohort-based ARPU.

A cohort is a group of users who share similar traits, such as the date of install, geo-location, device type, and so on.

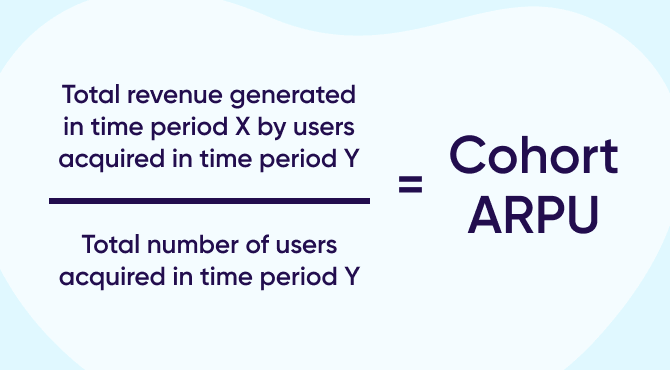

Cohort-based ARPU refers to revenue generated by new users in a set period of time. This can help you determine your return on investment (ROI) and how your mobile user acquisition (UA) efforts are going.

You can calculate it as follows:

For example, you could measure the average revenue per user generated within 30 days (known as Day 30 ARPU) for all users acquired in May.

Remember that in this scenario, even if a user installed your app or visited your website for the first time on May 30, the revenue they generated over the next 30 days (in June) would still count towards your May cohort ARPU.

As is often the case in marketing, “good” depends on your business and industry. For example, a gaming app may rely on small, regular, in-app purchases — whereas an eCommerce app may bring in high-value orders, less frequently. A streaming or wellbeing app with a monthly subscription fee will be different again.

What matters is that your customers bring in enough revenue to make your business profitable, once you deduct all your running costs. If not, you need to look at how you could increase ARPU and/or reduce your expenses.

ARPU can be affected by various factors. Understanding these will help you interpret your number and take the right action.

Charging a set monthly fee is an easy way to stay on top of your ARPU. But you can’t just set a price and forget about it: you should review your prices regularly to ensure you’re offering value and staying profitable. Premium subscription tiers, with added benefits, are a way to keep ARPU trending up.

If your business has a high churn rate — in other words, customers don’t stay for long — you’re missing out on revenue. And if it’s high spenders who leave, your ARPU could really take a hit.

By keeping users engaged with your brand and constantly improving your offering, you should see lower churn and higher ARPU.

If most of your users spend very little, it’ll drag your ARPU down. Keeping your higher spenders happy — and growing their number — will make sure it’s heading in the right direction. Likewise, a small number of high-value users could skew your figure upwards. Digging into the details will stop you being lulled into a false sense of security.

For professional services, one paid account often includes multiple seats (users). That translates into lower ARPU, so it’s important to factor this into your pricing.

ARPU can vary depending on where your business is at, and what your goals are. When you’re starting out, you’re focused on awareness and acquisition: you might offer discounts and free trials, and your product may still be evolving. Further down the line, with a solid customer base and an established reputation, you can focus on growing revenue by offering additional features and upgrades.

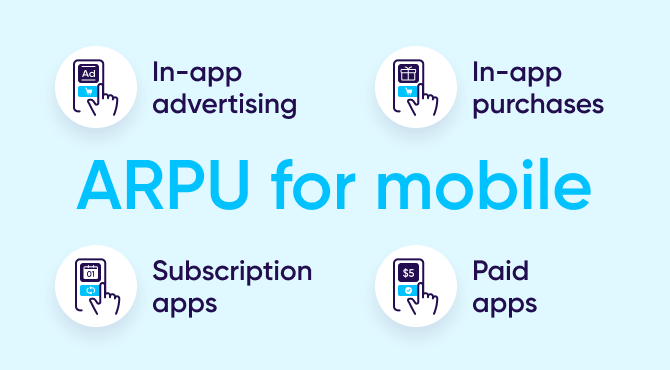

In the competitive mobile ecosystem, where the majority of apps are free to download, app owners rely heavily on in-app events to generate revenue.

Revenue from in-app events can be generated in one of four ways, outlined below. If you have multiple income streams, calculating the ARPU for each one and comparing them will help you get the balance right.

With in-app advertising (IAA), advertisers pay app owners to display their messages within the app.

It’s a fast-growing market, as more app owners recognize the value of their in-app real estate.

Done right — with relevant, well-designed, and timely ads that don’t breach privacy regs — IAA can be a win-win, bringing in significant revenue that grows with every view.

Getting users to spend money in your app sounds like a fast track to improving your ARPU. But it’s easier said than done: typically, only a small proportion of users (we’ve found around 5%) actually make in-app purchases (IAP).

Work out who’s spending, where, when, and why to get your numbers up.

Regular app subscriptions are a good way to bring in a steady income, provided users feel they’re getting value for money.

You can use ARPU to help you understand which pricing models get the best response from customers. Perhaps there is a specific bundle that is attractive to a particular cohort.

Offering a tiered subscription model also provides good opportunities to grow your ARPU through upselling.

Statista reports that around 97% of apps in the Google Play Store are now free, while for Apple, it’s just over 95%.

Users who download a paid app tend to be loyal, but they’ll also have high expectations — they might not want to see ads or pay for additional content, for example.

So, while your ARPU may be stable with a paid app, it could be hard to shift the dial on it.

With just one extra letter, you’d be forgiven for confusing these acronyms. But ARPPU refers to average revenue per paying customer over a given time period.

This metric is popular with app marketers operating a freemium model: the app is free to access, but generates revenue through in-app purchases or advertising. While many users won’t engage with these features, a certain proportion will be lucrative. ARPPU enables you to isolate these users (sometimes known as whales) and identify which strategies bring the best results.

ARPPU is also useful where you’re offering a free trial, for instance, as you can exclude those non-paying users from your calculation.

ARPU and LTV (lifetime value) are very similar metrics, and are sometimes used interchangeably. But there is a difference, and it’s to do with timeframes.

While ARPU focuses on a set time period with a clear start and finish, LTV looks at the entire time a user spends with you, from initial interaction with your brand right up until they churn.

Where it gets confusing is that the time periods could be equal. For example, say you’re measuring May ARPU, but a user purchases and then churns within the month of May. That means if you measure their LTV, it’ll be the same.

LTV does offer a bit more depth than ARPU: for example, it can help you measure how valuable a user was before they churned, or how well you’re retaining customers. LTV is also the true north when it comes to optimizing your ROAS and reaching that magic state where revenue per user is greater than cost per user (read: you’re making $!).

ARPA stands for average revenue per account, and is a metric primarily used by SaaS businesses. It’s similar to ARPU, but reflects the fact that one account can often have multiple users.

It’s useful to split out new and existing ARPA, so you can see how accounts perform over time and address any issues. Further segmentation — by industry, client size, or onboarding date, for example — can provide deeper insights into what clients value, how to keep them engaged, and where you could increase revenue.

Whereas ARPU can show revenue over any given time period, ARPDAU refers to active revenue per daily active user.

By its nature, ARPDAU is a short-term metric, but it’s great for seeing results in real time. For example, if you’re running a time-limited campaign offering a discount on paid subscriptions, you can immediately see the impact on your bottom line.

However, ARPU gives you a broader overview of your channels and platforms over time, making it a better indicator of long-term performance.

ARPU is undoubtedly a useful metric, but it does have some limitations. Here are a few to watch out for:

The good news is that there’s a variety of ways to improve your ARPU. Here are some of the top ones.

If you run a subscription-based service, you may find that adjusting your pricing plans will improve your ARPU.

This could include adding in extra features to attract users to more premium plans, or lowering the monthly rate if a user pays upfront for the year.

Measuring your ARPU based on your user acquisition efforts will highlight which channels, creatives, or campaigns are delivering high value users. For mobile, you can also assess the value of the different advertising networks.

Once you identify a trend you can double down on your investment and grow your ARPU further. Equally, if you notice a campaign or channel is delivering a lower-performing ARPU, then you can drop it and focus your resources elsewhere.

We all know retention is much cheaper than acquisition — so it makes sense to work hard on retaining your most valuable users.

Analyze whether there is a trend for users churning and launch a remarketing campaign at that point to keep them interested. Loyalty plans can be effective at encouraging users to stay with you: consider free boosters for regular gamers, or discounts for frequent shoppers.

If you can keep your brand top of mind, users are more likely to choose you when they want to make a purchase. You can do this in various ways, for example:

We’ve said it before, and we’ll say it again: nothing beats building up in-depth user personas to help you really connect with your customers.

With your ideal user in mind, you can shape your product or service to meet their specific needs. You can also identify the marketing messages, channels, and timing that resonate most with them — helping you to step up your ARPU game at both acquisition and retention stage.

One obvious way to increase your ARPU is through upselling, aka encouraging existing users to upgrade. That could mean moving to a subscription plan with added benefits, or treating themselves to a more premium product.

Cross-selling is another easy win: if you’re enjoying our fitness app, why not try our healthy recipes app too?

The acronym ARPU stands for Average Revenue Per User.

To calculate ARPU, divide your total revenue by the number of users over a set period (typically monthly for subscription models). This will show you the average revenue generated from each user.

ARPU is crucial as it provides insights into the revenue generated from each user, offering a snapshot of business health that can guide your strategy. Understanding ARPU can help businesses optimize marketing strategies, improve return on ad spend, and uncover revenue opportunities by identifying high-value user segments.

Cohort-based ARPU focuses on the revenue generated by new users within a specific period, offering deeper insights into the effectiveness of user acquisition strategies by comparing user segments.

While ARPU calculates the average revenue across all users within a specific timeframe, ARPPU (average revenue per paying user) focuses specifically on the revenue generated from paying users. This offers insights into the value of users who actually make purchases or subscribe.

ARPU measures the average revenue generated from each user over a set period, such as a month or year, providing a broad view of revenue generation. In contrast, ARPDAU (average revenue per daily active user) focuses on daily revenue from active users, giving immediate insights into revenue fluctuations and campaign effectiveness on a daily basis.

ARPU provides a snapshot of the average revenue each user brings in over a specific period, which is useful for short-term revenue assessment. LTV (lifetime value), however, evaluates the total revenue a user is expected to generate over their entire relationship with a business, emphasizing long-term value and customer retention strategies.

Strategies to improve ARPU include adjusting pricing plans, optimizing user acquisition campaigns, focusing on user retention, enhancing user engagement, understanding customer needs deeply, and exploring cross-selling and upselling opportunities.

ARPU is one of the most relied-upon metrics in marketing as it gives an overall picture of how well you’re doing at generating revenues.

Remember that: