Introduction

The way we watch TV has changed forever. Gone are the days of planning your evening around the TV schedule, or waiting a week for your next episode. Now, thanks to connected TV (CTV), you can binge your favorite shows whenever — and wherever — you like.

In fact, 87% of American households now own at least one CTV device (one that can stream video content over the internet), and the average viewer is watching nearly six hours of content this way each week. That represents a huge opportunity for advertisers.

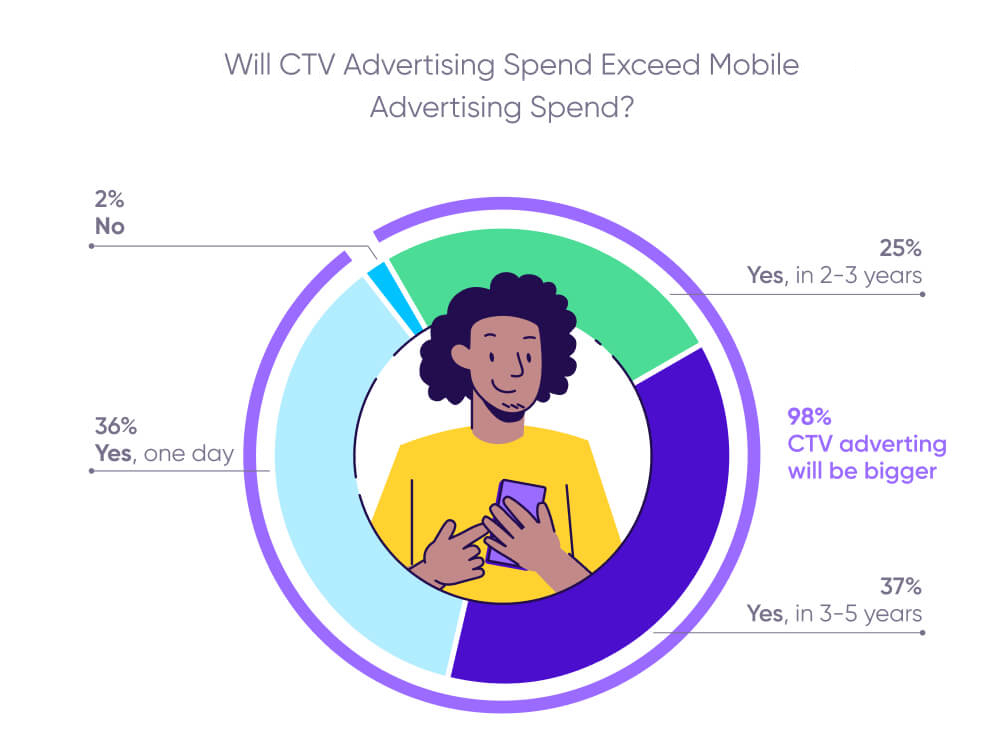

Also, based on the perspectives of 98% of brands, CTV advertising is projected to surpass mobile advertising in ad spend eventually, with 25% anticipating this shift within the next 2-3 years, and 62% expecting it to occur within 5 years.

Streaming platforms have spotted the potential too. Where previously, viewers paid a premium to enjoy ad-free content, big players like Disney+ and Netflix are now offering budget-friendly, ad-supported tiers to broaden their audiences — while successfully monetizing their content through advertising.

Whether you’re an advertiser, a publisher, or just a keen viewer, CTV is a hot topic. In this guide, we’ll dig into what it is, how the ecosystem works, and why advertisers love it so much.

Let’s get right into it.

Chapter 1

What is connected TV (CTV)?

Connected TV, or CTV for short, refers to devices that connect to the internet and allow viewers to watch video content.

CTV devices include smart TVs, games consoles like Xbox or Playstation, and streaming devices like Apple TV, Google Chromecast, Amazon Fire TV Stick, and Roku.

What’s the difference between CTV and OTT?

Before we get into the weeds of CTV, let’s clear up a common misconception: CTV is not the same as OTT (over the top).

OTT providers, as the name suggests, provide their content “over the top” of traditional cable, satellite, and broadcast TV. Popular ones include:

- Netflix

- Disney+

- Hulu

- ESPN+

- Amazon Prime Video

- HBO Max

- Apple TV+

- CBS All Access

- YouTube TV

- Starz

- Pluto TV

- Sling TV

- Tubi

- Fubo TV

- Peacock TV

- Vudu TV

- Crackle TV

- Kanopy TV

Put simply, you can use a CTV device to watch OTT content, via a dedicated app or site. If you want to explore the differences further, check out our guide to CTV vs OTT advertising.

What does the CTV ecosystem look like?

Now we know the difference between CTV and OTT, let’s talk about the ecosystem. Technology companies are fighting for ad space, and it all comes down to data.

CTV operating systems collect rich data for advertisers to capitalize on. As a result, the battleground has shifted to operating systems rather than physical TVs — and the environment is highly fragmented.

While Samsung and LG lead the smart TV market, they face stiff competition from other CTV devices. In fact, data from the US shows that Roku and Amazon Fire TV together hold about the same 60% market share as all smart TVs combined. (Amazon’s Fire TV line has Alexa, Fire OS, and Prime Video distribution embedded out of the box.)

The fragmented components of CTV – and how it impacts advertisers

The CTV ecosystem is a busy place. Let’s take a look at the key players:

- Broadcasters provide exclusive streaming content (Hulu, Disney+, Netflix).

- CTV-enablement devices offer TV streaming (Roku, Amazon Fire TV Stick).

- Smart TV devices have streaming capabilities (Samsung TV, LG TV, TCL TV).

- Mobile Measurement Partners (MMPs) accurately measure campaign performance and combat fraud.

- Supply-side platforms (SSPs) are software solutions that manage the advertising exchange from the publisher’s side — including selling ad space, optimizing deals, and measuring campaign performance.

- Demand-side platforms (DSPs) are programmatic tools that mediate ad buys and provide inventory in a single interface. DSPs also serve advertisers to purchase ad impressions for the lowest CPM.

- Advertisers buy ad space to give their brand visibility.

- Publishers and networks sell advertising inventory, and include players from above categories such as smart TV device manufacturers (Samsung Ads, Vizio Ads).

The challenge for advertisers is that every inventory source collects data differently, resulting in different insights. Some providers use pixels for more accurate measurement and engagement.

Often, providers operate in walled gardens, which force advertisers to work directly with them, deal with varying and limited data sets, and prevent user-level data from leaving their individual platforms.

The result? An extremely competitive and fragmented marketplace, where advertisers face challenges around accurate measurement and attribution.

CTV ad types and how to display them

Unlike a linear TV spot, CTV offers advertisers an array of ways to get their message across.

The most common ad formats are:

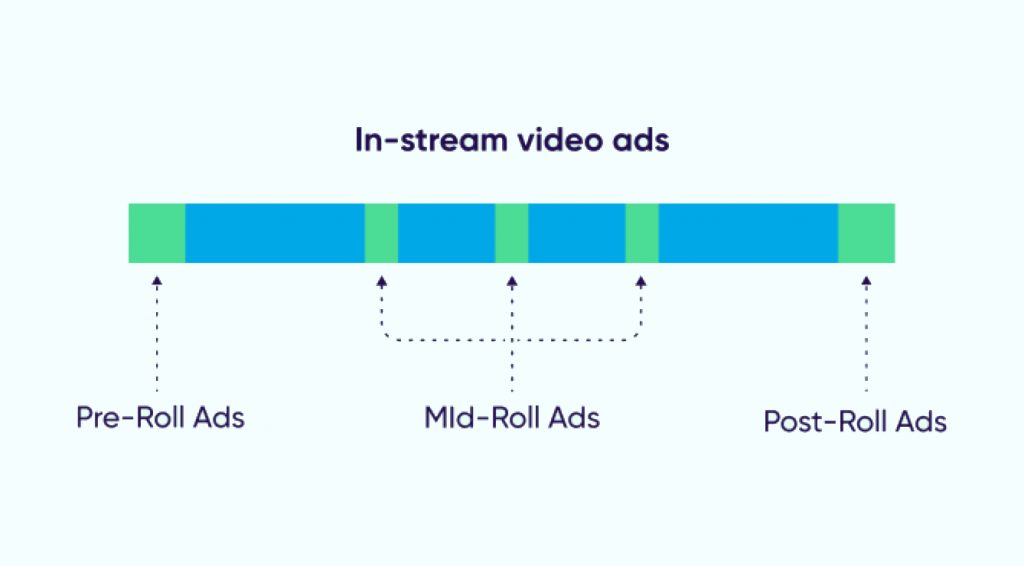

- In-stream video ads: This is the most common type of ad. In-stream video is available across all platforms and integrates into streamed content, in a similar way to commercial breaks on linear TV. These brief ads can run before, during, or after the chosen content.

- Interactive video ads: These creative ads invite users to interact, for example by scanning a QR code. They can appear during or after the content, or as an overlay. Although not available on all platforms, advertisers appreciate the engagement data that interactive video can provide.

- Display ads: These are commonly shown on the homescreen of the CTV platform, or as an overlay while content is streaming. That means they tend to be quite small in size, but they can last longer than in-stream ads and be effective at reaching a wide audience.

How do I display my ads?

As an advertiser, there are three main ways you can buy inventory to display your CTV ads.

1 – Programmatic

Programmatic advertising is the automated, data-driven media-buying process that’s taken the digital advertising world by storm.

By using DSPs and ad networks, you can achieve wide reach across platforms at low cost. In addition, you’ll benefit from sophisticated segmentation and reporting capabilities.

While most programmatic deals take place through real-time bidding (an open auction for ad impressions), another option is to use a private marketplace (PMP). This can help you reach a more niche audience, although targeting can’t usually be guaranteed at the program or platform level.

Bear in mind that programmatic ad formats are usually limited to non-clickable video (such as in-stream video ads). This is because CTV platform providers hold the keys to homepage placements and clickable display formats.

Depending on your budget and in-house resources, you can choose from a self-serve or managed programmatic service.

Self-serve platforms (the cheaper option) tend to be DSPs that grant access to ad channels and publishers. Examples include MNTN, Vibe.co, TvScientific, Taboola, and AdRoll. You control every aspect of your ads, from set-up to bidding, scheduling, tracking, and real-time optimization.

With a managed service (like Vibe.co or TV Scientific), you’re still in charge of the strategic and creative decisions — but you’re paying a third-party team to manage the day-to-day running of the campaign. They also have the expertise to provide detailed measurement, reporting, and insights.

2 – Platform direct

An alternative to programmatic buying is to purchase ads directly from CTV platforms, where viewers gain access to a variety of streaming apps (OTTs).

This can sometimes lead to lower rates and more placement options, although you should be aware that each platform has its own rules and offering.

3 – Publisher direct

The publisher direct route lets you make deals directly with the OTT service provider.

This gives you more control over placement – you can even guarantee placement in specific programs or channels, making this a popular premium option. But that comes with a premium price tag, and what’s more, your exposure may be more limited.

Chapter 2

Benefits for advertisers

As outlined above, we found that 98% of brands believe CTV advertising will overtake mobile advertising in the next two to three years. And in the US, CTV ad spend is set to soar to 40.9 billion dollars by 2027 — starting to close the gap with linear TV, where budgets are shrinking or stagnating.

But why are advertisers so excited about this technology? Let’s find out.

Segment like never before

Traditional TV offered limited opportunities for audience segmentation. It heavily relied on estimates from third parties such as Nielsen, making it much harder to be sure of reaching your ideal audience.

In the CTV space, however, advertisers can reach out to audiences based on their precise demographics, interests, context, time of day, device, and geography. Armed with that detail, you can develop customized, hyper-local ads that resonate.

Improve reach and engagement

The rapid growth of OTT platforms opens up a vast audience, as viewers increasingly choose streamers over linear channels.

Whereas linear TV audiences might passively watch whatever comes on, CTV viewers are able to seek out the content that really interests them. With a seemingly endless supply of bingeworthy content on offer, you’ve got a highly engaged audience in the palm of your hand, resulting in high video completion rates.

Protect your brand

If there’s one thing advertisers love, it’s control. You don’t want to risk your ad appearing in a place that’s irrelevant or, worse, inappropriate. The precision buying systems that underpin CTV advertising make it much easier to show your ads at the right place and time.

Measure and report like a pro (even across devices)

CTV gives you access to a wealth of data and insight on your ad performance, much of it in real time (or near enough). That means if something isn’t working, you can take action to fix it now, rather than wasting your budget.

CTV audiences frequently move between devices: 50% of Americans have downloaded a mobile app after watching a CTV ad. QR codes or links powered by deep linking technology make that journey smoother, creating a positive return on experience (ROX). And with detailed attribution data, you can track performance, measure ROAS, and optimize future campaigns.

Crucially, in today’s privacy-centric world, CTV data is anonymized and doesn’t rely on cookies or user opt-ins.

Maximize your budget

While a top TV spot is out of reach for many brands, budget-wise, CTV is open to all. You can set your budget and choose your payment model. You can use a variety of platforms, and extend your reach across channels.

With the segmentation and optimization abilities described above, you can be sure every dollar of your campaign spend is working for you.

Chapter 3

CTV & OTT monetization models

Now that we’ve covered how CTV and OTT work, let’s talk about money. There are five primary monetization models that you should know about.

1 – Subscription video on demand (SVOD)

The most widely used model, SVOD requires users to pay a monthly or annual subscription fee for unlimited access to content.

Platforms like Netflix, Amazon Prime, and Disney+ use this revenue to create a library of fresh, exclusive content, resulting in a loyal viewer base.

2 – Advertising-based video on demand (AVOD)

With AVOD, viewers can access content for free while the publisher relies on revenue from advertising: think YouTube or Crackle.

As well as ads stitched into the video content, publishers can monetize with banner ads, sponsorships, and paid placements: advertisers pay whenever their ad is viewed.

3 – Transactional video on demand (TVOD)

The TVOD model generates revenue by charging viewers to access single pieces of content. It works well for premium or exclusive content such as new movie releases or pay-per-view events.

4 – Hybrid model (HVOD)

With increased competition in the OTT space and household budgets stretched, more services are opting for a hybrid approach, combining different monetization models to attract and retain more users.

For example, Hulu offers a baseline ad-supported plan, a non-ad plan, and a bundle that comes with Disney+, ESPN+, and Live TV. Netflix and Disney+ have taken a similar approach, introducing free, ad-supported options alongside their traditional subscriptions.

5 – FAST

FAST, short for free, ad-supported streaming TV, gives users a similar experience to traditional, linear TV. Although you’re watching over the internet, content is supported by ad breaks, and you can’t choose what to watch.

Unlike with linear TV, however, advertisers can use dynamic insertion to tailor the ads to the audience, based on deep insights.

FAST is rising, well… fast, with Pluto, Roku, and Peacock among the most popular services.

Chapter 4

CTV measurement and attribution

Because CTV advertising is so rooted in data, it’s possible to measure the success of your campaigns, and attribute results to the right sources, with pinpoint accuracy. A good MMP can help you navigate the fractured landscape (outlined in Chapter 1), providing centralized, unbiased attribution across media sources, channels, and devices.

Here are two key user journeys you’ll want to follow:

CTV-to-CTV attribution and measurement

CTV-to-CTV attribution is where CTV ads result in CTV app installs, on the same device or operating system.

Where things get tricky is that each CTV platform provides its own reporting method, and the reporting itself may vary in terms of consistency, granularity, and naming conventions. This is where an MMP can help, by providing a consolidated dashboard.

By working with an MMP that integrates directly with CTV platforms like Roku, Fire TV, Apple TV, Android TV, Chromecast, gaming consoles, and smart TVs, you’ll access deeper metrics such as LTV and metadata for better attribution.

CTV-to-mobile attribution and measurement

CTV-to-mobile attribution is where viewers install a mobile app after seeing it advertised on a CTV device.

Mobile app marketers buy media on CTV to drive these conversions, resulting in better growth and engagement for their app.

Again, partnering with an MMP that integrates with the various platforms will ensure your app installs and post-install events are accurately measured.

Chapter 5

CTV marketing trends

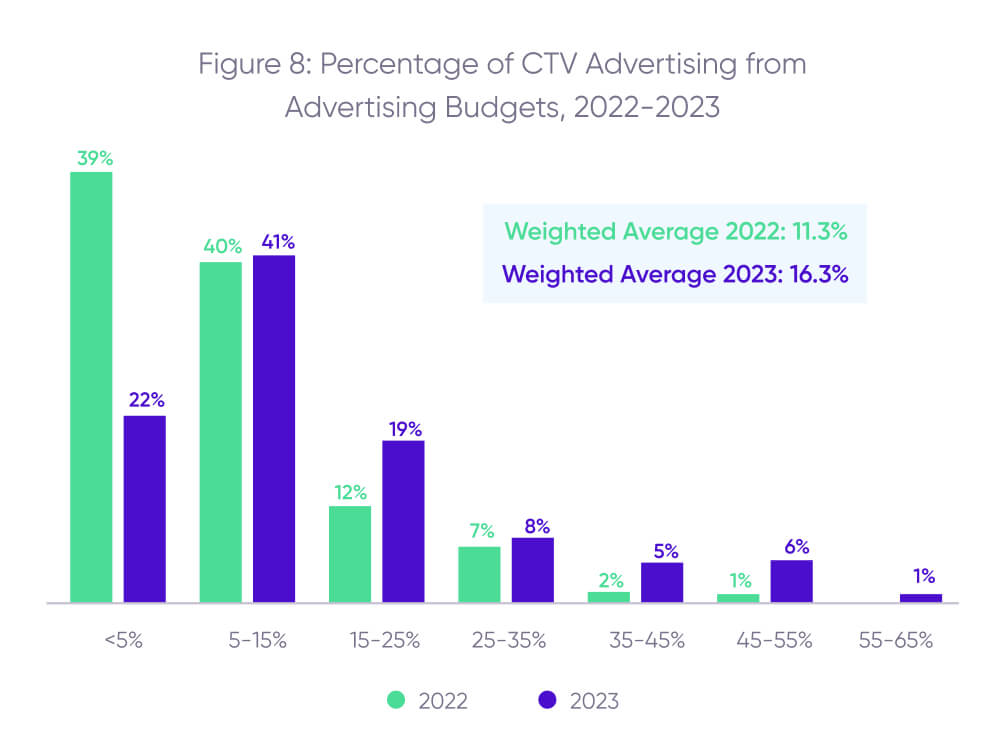

As more brands catch onto the potential of CTV, they’re channeling more of their advertising budget this way: the percentage of total advertising dollars spent on CTV was expected to jump 44% from 2022 to 2023 alone.

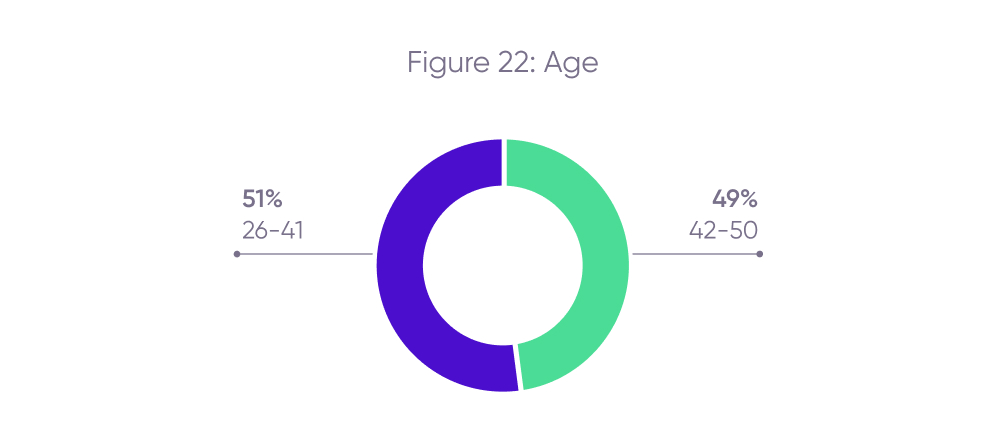

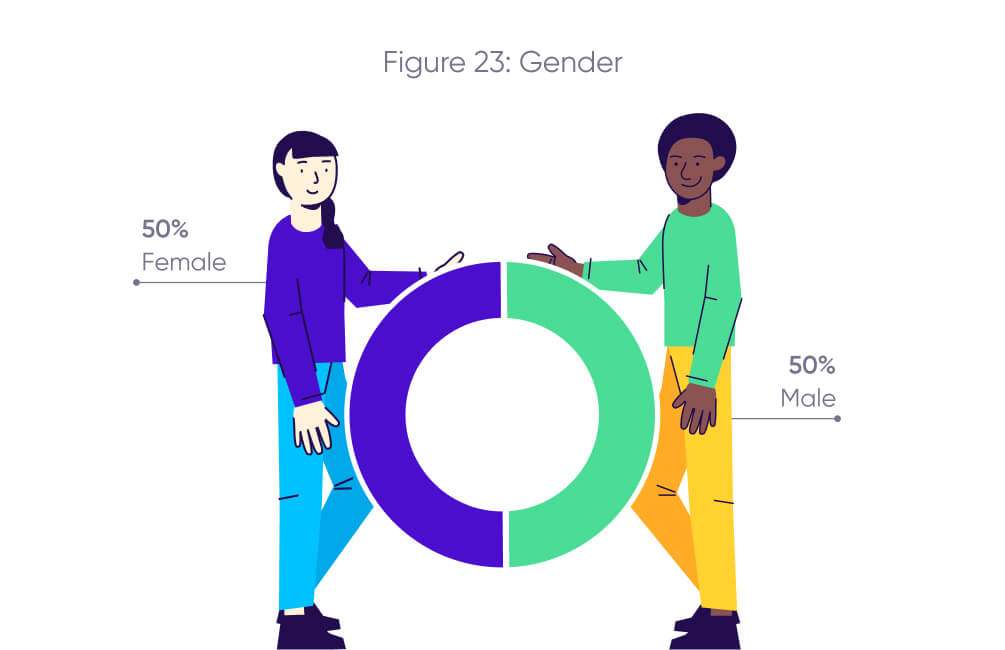

And with good reason: we found CTV is almost as popular with 42 to 50 year olds as it is with younger viewers, with an equal split across male and female audiences. That gives you an impressive reach.

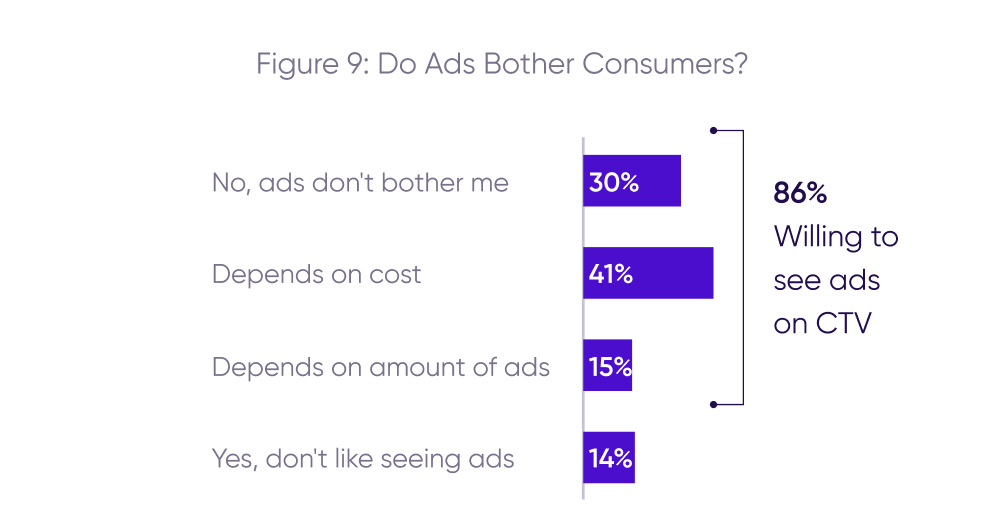

But how do the viewers themselves feel about it? Well, we found that 86% are willing to see ads on CTV, with 30% saying it doesn’t bother them at all. However, it’s crucial to get the frequency and relevancy right, as well as respecting user privacy.

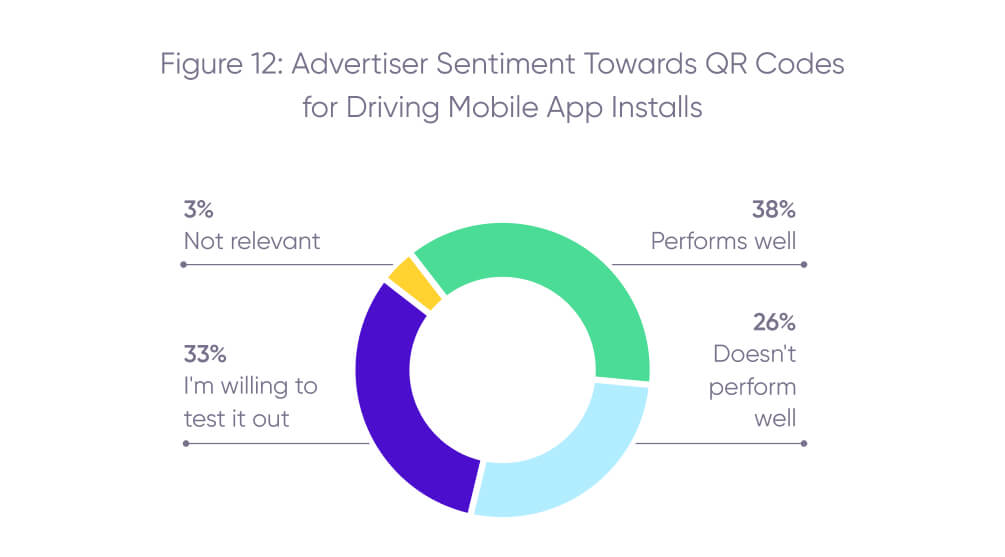

What’s more, consumers are increasingly comfortable scanning QR codes, for example to download an app. As well as signaling high engagement, this enables brands to accurately measure attribution and create smooth cross-device journeys.

With advertisers, publishers, and viewers all embracing CTV, we see plenty of scope for the industry to grow and develop, particularly in sectors like FinTech where adoption has been slower.

For more insights and trends, read our Connected TV Trends report for 2022-23

Chapter 6

CTV best practices for advertisers

Now, let’s dive into how you can craft a strategy to measure the effectiveness of your CTV campaigns.

Step 1: Study your data

Gross Rating Points (GRP) is a widely accepted metric to measure the effectiveness of traditional TV advertising buys, where advertisers pay publishers based on their respective rating points for that ad.

But this metric doesn’t fully capture the behavioral data of your CTV audience. So, here are a few ways you can measure the effectiveness of your campaign:

- Post-view website visit attribution: viewers visit your website after watching a CTV ad.

- Online purchase attribution: an ad viewer made a purchase on your website or via CTV after watching an ad.

- Post-view conversions: viewers installed your mobile app and made a purchase on the app after seeing a CTV ad.

- Foot traffic attribution: omnichannel engagements and purchases after viewing an ad.

- Offline conversion tracking: measuring how many times an individual has watched an ad before a purchase is made.

- Brand lift/brand awareness: your market positioning, measured by how people are able to recall and engage with your brand after viewing a CTV ad.

Keep in mind that gathering this data isn’t always simple, so working with a good MMP is key.

Step 2: Hone in on your audience

To identify your most profitable audiences, start with your current audience lists and build lookalike audiences. Then dive deeper into third-party data such as interests, demographics, devices, and geographic location.

The more granular you get, the more you can expand your reach to deliver relevant messaging to your viewers – and ultimately drive higher-converting CTV campaigns.

Step 3: Measure, evaluate, iterate

Digital advertising is all about data – and CTV is no different. Here are some of the main KPIs to focus on:

- Measuring impressions, reach, and frequency can show you how many people are seeing your ad, and how often.

- You’ll also want to keep track of your costs, whether that’s cost per mille (the price you pay for a thousand impressions), or cost per completed view of your ad.

- In terms of results, you should monitor conversion rates and that golden metric, ROAS.

You need to constantly measure, evaluate, and iterate, using the audience insights and the data you’ve collected to continually optimize your campaigns.

An MMP can make this easier by resolving deduplication issues, flagging ad fraud, and accurately measuring your attribution.

Step 4: Fight fraud

With so many advertising dollars pouring into CTV, fraudsters saw a golden opportunity to pounce.

The three most common types of fraud are:

- Device spoofing: using bots to impersonate another computer system.

- Multiple device spoofing: pretending to be watching on multiple devices.

- SDK spoofing: adding code to an app to generate fake app installs, purchases, and clicks.

But don’t panic. There are simple steps you can take to fight back and keep your users – and your budget – safe from harm:

- Only work with reliable CTV providers, with transparent and accessible campaign measurement capabilities (such as pixel tracking)

- Work with a trusted MMP to ensure your data is accurate, fraudulent activity is flagged in real-time, and your users’ privacy is protected in full.

- Study your numbers for any abnormal behavior patterns. Do these installs match the viewing habits in this geography or platform? Did users uninstall the app immediately after downloading it? Are there unusual app activity spikes that seem off to you?

Key takeaways

- A CTV device is one that lets you stream content over the internet. Don’t confuse this with OTT, which refers to the content you watch on your CTV device.

- 87% of American households own at least one CTV device, and the majority of viewers don’t mind watching ads, creating a significant opportunity to reach a vast, engaged audience.

- However, the CTV ecosystem is fragmented, with a variety of devices and operating systems vying for attention.

- CTV ad formats include in-stream video, interactive video, and display ads. Most inventory is bought through programmatic deals, offering wide reach at low cost, but you can also use platform direct or publisher direct methods.

- Investment in CTV advertising is booming due to its effective segmentation and measurement capabilities, engaged audiences, brand safety, and cost-effectiveness.

- CTV monetization models include SVOD, AVOD, and TVOD, with many providers opting for a hybrid of these. Another option is FAST, which is more like linear TV.

- The fragmented environment and various reporting approaches can make accurate campaign measurement challenging, but an MMP can help by providing centralized data across platforms and devices. They can also help with attribution, including for CTV-to-CTV and CTV-to-mobile journeys.

- To get the most out of CTV advertising you should study your data, and get to know your audience. Work with a trusted MMP to constantly measure and optimize your campaigns as well as fighting fraud.