Cutting mobile ad fraud and saving big with the right fraud solution

$300K

Savings in ad spend30%

Reduction in fraudulent installs6.3%

Increase in conversionBackground

As the Philippines’ tenth-largest bank by total assets, UnionBank has long been a key player in the areas of transformation, people, and culture.

It has also been recognized as the “Best Digital Bank” by prestigious institutions such as Asiamoney and was recently named the second-most helpful bank in the Asia Pacific during the COVID-19 pandemic by the BankQuality Consumer Survey on Retail Banks—the only Philippine bank in the top 20 list. It was also most recently named the “Best Retail Bank in the Philippines” at the Asian Banker International Excellence in Retail Financial Services Awards 2020.

UnionBank has now accelerated its efforts to improve on its customer experience by investing heavily in financial technologies such as data analytics and artificial intelligence. This past year alone, the bank launched an online lending marketplace, an e-commerce platform, and a blockchain platform, in addition to having onboarded dozens of rural banks.

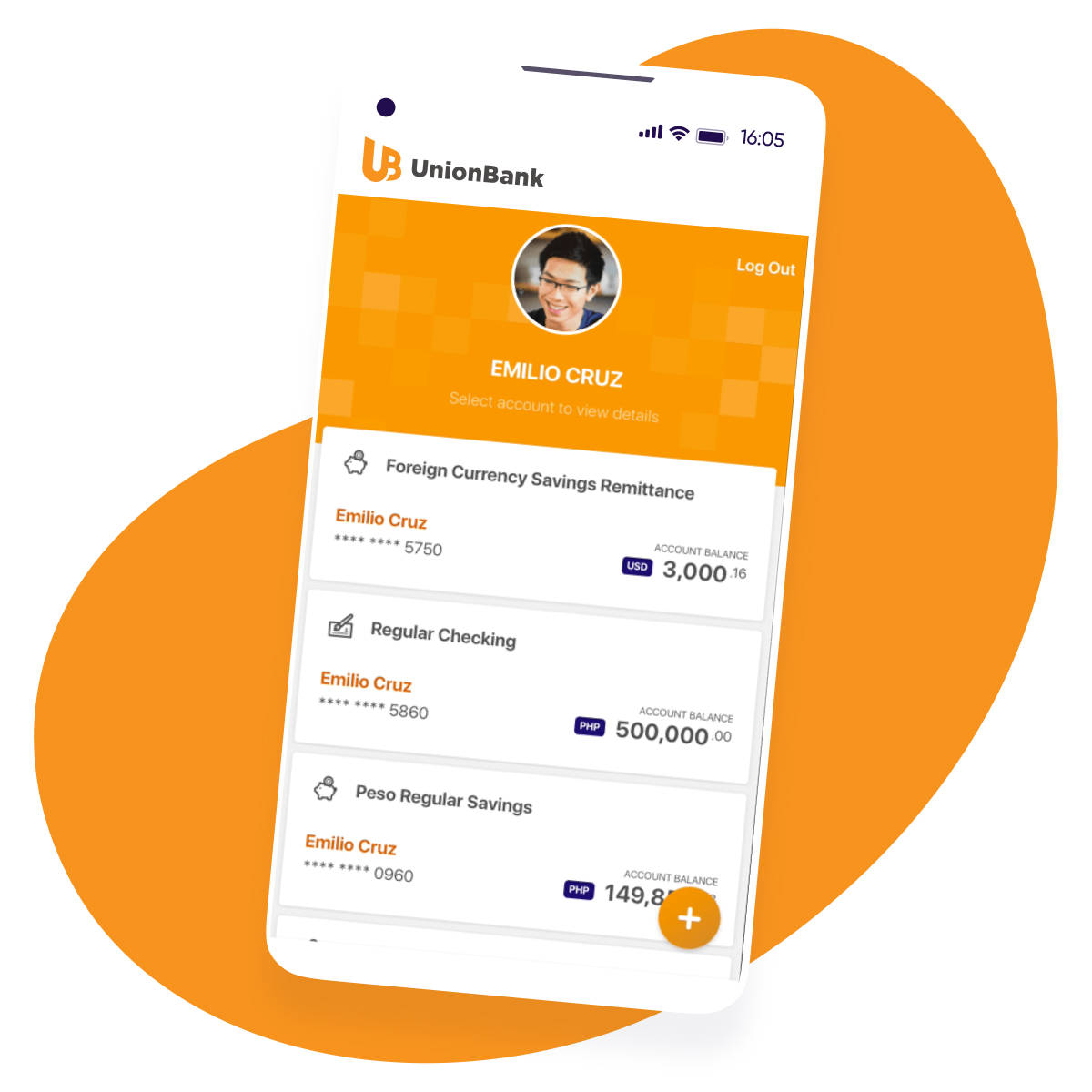

One of its innovations is the UnionBank Online app – equipped with features its competitors lack such as in-app account opening and mobile check deposit – has quickly become indispensable to their customers. As the COVID-19 crisis worsened, UnionBank launched a remittance feature that allowed millions of Filipinos to send money to their families affected by the pandemic, and to receive money through more than 4,000 remittance centers nationwide.

With its drive to “Tech Up Philipinas” and to support the Philippines’ push to become a G20 country by 2050, UnionBank stands firm on its promise to power the future of banking by co-creating innovations with and for its customers.

Challenge

UnionBank’s aggressive push into digital technology precipitated the need to fast-track its user acquisition efforts.

The bank did this by working with self-reporting networks while through owned media channels. To keep the momentum going, however, UnionBank also began expanding to more partners and media sources – a strategy that came with certain risks. Fraudulent installs rose to the point in which it became a pressing concern for the marketing team.

This wasn’t altogether unexpected.

AppsFlyer’s State of Mobile Fraud found Finance apps to be most susceptible to fraud attacks, identifying the Philippines as a particularly hard-hit regional market – its fraud rate was above 39% for the year – while the fraud rates for finance apps in the Asia Pacific region were over 30%.

A market with high fraud rates means it’s risky for companies like UnionBank to correctly allocate and optimize their budget for ad spend. Therefore, they had to determine which media sources delivered high-quality users that could then be ushered further down their conversion funnel.

Solution

Upon identifying the partners they wanted to work with, UnionBank measured their performance by integrating them with AppsFlyer.

The marketing team quickly began to notice some questionable activity, such as when installs were high and yet conversion rates (in-app account openings) were suspiciously low, considering the volume of paid media spent.

To solve this, UnionBank turned to AppsFlyer’s fraud protection suite, Protect360, which allowed both UnionBank and its two main media partners to identify which site IDs were suffering from the highest rates of fraud.

Results

It turned out that both of the bank’s media partners were targets of astonishingly high fraud rates – 52% and 88%, respectively. After notifying their partners, UnionBank also granted them access to Protect360.

Backed by AppsFlyer’s fraud protection solution, it became faster and easier for partners to clear media sources with high rates of fraud, regardless of fraud type.

According to the data gathered, timestamp anomalies (which indicate either install hijacking or click flooding) and the use of device emulators (a tool used by fraudsters for various bot-related fraud schemes or large-scale device farms) were frequently detected. Based on postbacks on fraudulent installs, Protect360 flagged 279,000 cases of fraud in April alone, accounting for about 30% of total paid installs. After this incident, the partners increased their vigilance in assessing which inventories and site IDs to choose, and gradually improved their conversion rates.

Using AppsFlyer’s fraud solution, Protect360, UnionBank saw an increase in conversion rate of 5.5% and 6.3% in March and April, respectively. This translated into an impressive amount of savings – $330,000 – that would have otherwise been lost to fraud.

On the subject of these impressive results, Reagen Aguda, a Digital Media Marketing Manager at UnionBank noted:

“After discussing Protect360 with senior management, everyone was impressed and extremely satisfied with the end result—saving an exponential amount of money on advertising by blocking fraudulent installs.”

Not only did these savings help in spending efficiency allowing UnionBank to meet its KPI targets and boost the effectiveness of their acquisition campaigns, Protect360 would ultimately help the team set a new fraud benchmark in identifying which media partners to choose for their campaigns.

Looking for an MMP? Get your free assessment template today

Looking for an MMP? Get your free assessment template today