Mobile ad fraud prevention: Discover AppsFlyer’s cutting-edge tactics for stopping fraudulent networks

Just like the scammers calling you at ungodly hours about your car insurance, fraudsters are prevalent in the mobile ad world – and they’re much, much sneakier. Mobile advertising is nearly a $400 billion business, making it more and more attractive for fraudsters by the day.

We’ve been fighting fraud for years in various ways, but fraudsters are getting craftier and their methodology is getting more complex. The good news is, we’ve discovered a new way to fight it using advanced machine learning and clustering methodology, so we’re always two steps ahead.

How do fraudsters get in the door?

Fraudsters work through legitimate media publishers and sabotage large paid marketing campaigns. The higher the CPI or marketing budget, the bigger the reward.

Recommended reading: the marketer’s field guide to mobile ad fraud

It’s a lucrative business. Laundering networks are formed by fraudsters to steal mobile ad attribution. They can take credit for app installs by creating fake user profiles. In the simplest form, they’d reset Android devices and create new ad IDs. The perpetrators then send clicks, impressions, and installs on behalf of them, and earn the attribution.

That’s what laundering is – the concealment of money obtained illegally, by defrauding legitimate businesses.

But we don’t just sit around and hope for the best. The Appsflyer data science team works around the clock to not only prevent but proactively identify fraud, making sure we’re one step ahead.

Recognizing the pest problem

As our detection parameters began to evolve, so did the fraudster’s. Protect360 was initially designed to block publishers with large spikes of new users, which used to be an effective indicator of fraudulent activity.

As time passed, fraud detection rates inevitably began to slow down:

This led us to believe that the fake users were being pre-exposed to AppsFlyer organically, so they would fly under the radar. It was like a game of whack-a-mole, where we just weren’t beating our high score anymore.

Strategically placing the traps

Protect360 is an ever-evolving product, constantly innovating to detect new fraud techniques, which is why we developed a longer-term solution that solves the problem on a larger scale. What if we found a way to identify patterns of fraudulent behavior, which got smarter as time went on?

Here’s where it gets a little more complicated. We needed to develop an algorithm that detects first organic installs in the laundering phase. And instead of focusing on unique behaviors that the perpetrators can change at random at any time, it needed to identify deeper patterns through statistical modeling.

[Here are the results from the less naive algorithms:

As you can see, we were ecstatic about the results. Alas, the celebration ended only after a week, upon seeing the following results:

As you can see above, fraudster networks realized that we understand what they were doing, and they were able to overcome this fraud detection logic in less than a week.

Our solution: bringing in the exterminator

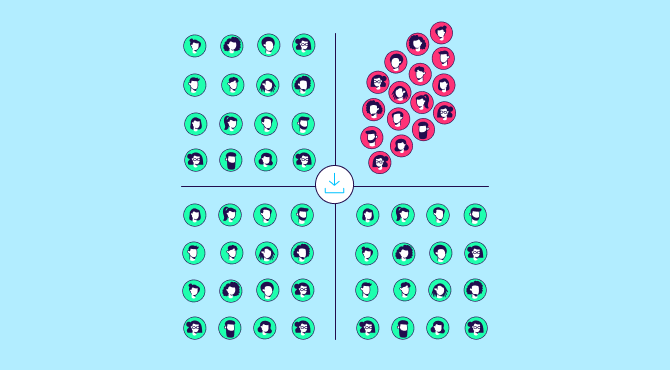

Our solution? A new unsupervised, machine learning model that clusters users that exhibit similar laundering behaviors. The model doesn’t need manually-created labels, and works when we don’t know the number of clusters to work with, and can handle big datasets (we’re talking 30 million users) to establish these clusters.

We can’t give our secret recipe away, so the actual clustering methodology will remain confidential as we continue to develop it. However, what we can share is that the model detects 60 different behaviors that differentiate between legitimate sources and fraudulent ones. The model currently detects about 1 million non-organic installs daily.

Here we can see the schematic visualization of the machine learning algorithm:

Keeping the fraudsters out

Instead of playing a never-ending game of cat and mouse, our machine learning model ensures we detect fraudulent behavior early, quickly, and at scale. But this isn’t where it ends. Our data science team will continue to develop the algorithm to ensure our clients are paying for real customers, not bots. Our goal is to keep your ad budgets safe and work with data that you can trust – and this puts us significantly ahead of laundering schemes out there.